Main FI Index | Main Newspaper Index

Encyclopedia of Trotskyism | Marxists’ Internet Archive

From Fourth International, May 1946, Vol.7 No.5, pp.145-149.

Transcribed, edited & formatted by Ted Crawford & David Walters in 2008 for ETOL.

The Murray “Full Employment” bill is a promise to stabilize capitalism by a controlled program of government spending, the same program that is advocated by Henry Wallace in his book 60 Million Jobs. Murray and Wallace propose to cure ailing capitalism by applying the new theories of the British economist, John Maynard Keynes. In a few short years the doctrines of the Keynesian school have been hailed and adopted by leading capitalist economists, and have become the new orthodox capitalist economics. Their speedy adoption is a direct result of the crisis of capitalism; new times call for new camouflage.

The Murray bill does not propose to set up a fund for public works or for unemployment relief, or any other form of government stabilization. It amounts to nothing but a pious promise. The president is directed to make a report to Congress once a year on whether business needs stimulation by government spending. A board of three economist experts is created to tell him what to say, at $15,000 a year per economist. After the president’s annual reports, Congress will act or not, as it chooses.

Before the Murray bill was finally passed and signed by the president, Congress modified the promise from “full employment” to “maximum employment,” but it enacted the concrete provisions, for the report and the board of experts, in original form. Congress took no “teeth” out of the bill because it had none to start with.

Yet the bill offers a Keynesian program, even though it doesn’t guarantee that Congress will do anything about it, and this program can be examined; first as to the aim of the Keynesian plan; second, as to the economic theory of it, and whether it can do all or any part of what it claims.

The authors of Keynesian plans dramatically promise jobs for all workers. Yet from their class background, it would seem more natural for them to be aiming at stabilizing capitalism from the employers’ point of view. Senator James E. Murray, the author of the “Full Employment” bill, is a millionaire lawyer and Montana copper heir. Henry Wallace, Secretary of Commerce and author of the book 60 Million Jobs, is a wealthy business man also interested in the national farm paper Wallace’s Farmer. In Britain Sir William Beveridge, author of Full Employment in a Free Society, is an Oxford professor and government economic adviser who was knighted for his support of capitalism after the first World War, and is carrying on after the second. John Maynard Keynes, Cambridge professor and director of the Bank of England, today is Lord Keynes, created First Baron of Tilton by the Churchill government for his services to the empire.

Every now and then in their writings these people admit their real fear is that capitalism couldn’t survive another depression. Their aim is to stabilize capitalism, not to give jobs to workers. Still, one might say that if they want to save capitalism by providing plenty of good jobs, we don’t have to object just because the offer comes from the bosses. But when we dig into the economics of this program it turns out to be a plan for full “employment” of capital, not of workers. Under capitalism, this must necessarily be the case.

To explore this question it will be necessary to begin with some elementary economics which seem too simple to need restating, and yet the Keynesians operate by creating confusion about these basic processes.

A detailed illustration will clear up the terms that they seek to confuse. A capitalist owns a factory for making, let us say, clothing. He also owns, or can borrow from the bank, some funds to buy raw material, such as cloth and thread, and to hire workers. He owns the necessary machinery and money for production, therefore he gives the orders to run, or to shut down and lay off the workers.

The capitalist estimates how much clothing he can sell at a good price and orders production of that much. His money is tied up in the commodities that have been produced until he sells them and gets his money back, plus a profit.

The central point here is that profit comes from production and is collected in the sale of commodities. The connection with production may be hidden by one or many steps in between. For instance, if this manufacturer borrows some bank funds the bank seems to draw interest from “loaning money” rather than production, but in reality, the bank’s interest comes from the factory’s production and sales, just the same.

The capitalist ties up his money in production, and he must sell the commodities at a good price or suffer a loss. Therefore, if he sees no market for the commodities he is wiser to shut down the factory and keep his money instead of risking it. Of course if he shuts down the workers go without jobs and society goes without clothing, but that’s the system. Under capitalism clothing factories are run by capitalists for increase of capital, and not by society for clothes.

Thus any single capitalist can allow the wheels to turn in his factory only when production will increase his capital. This also is true for the capitalist class as a whole; production is possible only when it will increase the total capital wealth. Capitalism cannot run on an even level; it must expand or perish.

If the clothing factory owner has made a profit, his money-capital has grown. But a mere growth of a hoard of idle money, without growth of the plant which it can serve, is not a growth of real wealth. Nothing irks a capitalist more than idle money, bringing no return. Moreover, if he and his fellow capitalists should try to pile up idle money, instead of buying commodities with it, their hoarding would discourage the production of commodities, since they could not be sold, and this would bring on a crisis in the economic system.

The solution, of course, is for the capitalists to invest their money-capital in real capital equipment, that is, buy more machinery and build more factories. Thus their real wealth would grow, their money would be invested to bring a profit, it would be buying commodities, machinery and building materials, and thus keeping the economic system in a healthy state.

This solution has this catch to it. There has to be a growing market to buy the additional commodities that the additional factories would produce. Otherwise the new factories would prove a losing investment. To maintain capitalism this growth must go on forever. When the capitalists can’t find new markets they can’t invest by buying machines for new factories. Their failure to buy throws workers out of jobs, workers who were part of their old market, and the further drop in their old market thus builds up into a crisis. The capitalists must have the very special condition of always finding new markets or they can’t even keep their old markets. Again it becomes clear that capitalism must expand or perish.

The problem of the capitalists is to keep finding a steady supply of new investment opportunities for their capital. Not employment for workers, but “employment” (in a loose sense of the word) for capital is their need.

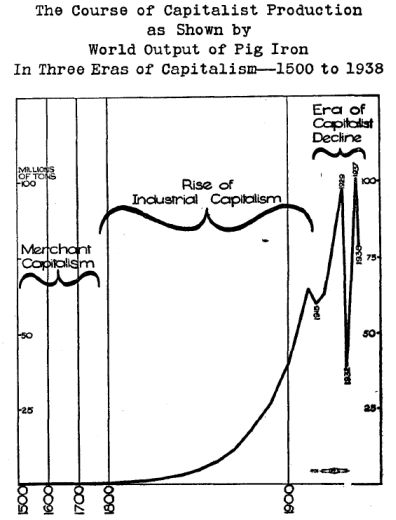

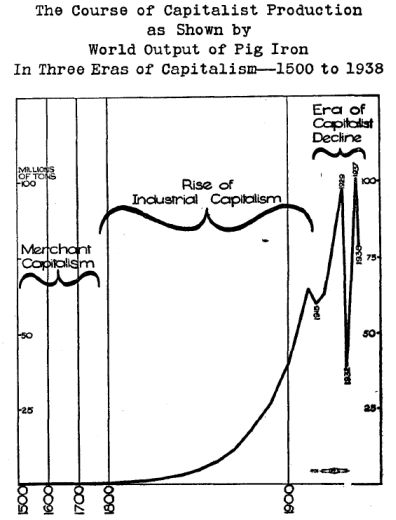

One might ask, how could capitalism have ‘survived so long if this unusual condition of steady expansion is really vital? Because capitalism was expanding. The factory system of capitalist production was becoming well established about a century and a half ago, by 1800. From that time to 1914, the curve of capitalist growth went exactly as would be expected from theory. The figures of world production of pig iron, a basic industrial material, which in a general way indicate the level of all capitalist production, show that for a century and a quarter this “special” condition of growth was the rule. For comparison, figures from the three previous centuries of the merchant capitalist era, while production was still on a handicraft basis, are included.

|

WORLD OUTPUT OF PIG IRON, 1500 to 1938 |

|||||||

|---|---|---|---|---|---|---|---|

|

Year |

|

Tons |

|

|

Year |

|

Tons |

|

1500 |

60,000 |

1870 |

11,840,000 |

||||

|

1700 |

104,000 |

1880 |

18,160,000 |

||||

|

1740 |

157,000 |

1890 |

26,750,000 |

||||

|

1790 |

278,000 |

1900 |

39,810,000 |

||||

|

1800 |

460,000 |

1910 |

64,760,000 |

||||

|

1810 |

616,000 |

1915 |

59,700,000 |

||||

|

1820 |

1,000,000 |

1920 |

62,850,000 |

||||

|

1830 |

1,800,000 |

1929 |

97,410,000 |

||||

|

1840 |

2,700,000 |

1932 |

38,989,000 |

||||

|

1850 |

4,700,000 |

1937 |

101,188,000 |

||||

|

1860 |

7,220,000 |

1938 |

79,344,000 |

||||

|

(Sources: Mulhall’s Dictionary of Statistics; Encyclopedia Britannica; |

|||||||

The astonishing regularity and scope of this growth appears more clearly when it is charted. The rise of industrial capitalism, a period of a little over a century, marks a real dividing line in human history. In the chart, the three centuries of merchant capitalism have been compressed, to give more room for the curve of the last 150 years.

|

Such a constant growth of new markets and new factories could go on while capitalism was a new system with a world to grow into. That period had ended by the early years of the present oentury when the capitalist empires had reached out and covered the world.

That meant no more growth for capitalism as a whole. Any single capitalist power could get a new market only by taking it away from some other capitalist power. Thus the First World War, in 1914, was the sign that the era of capitalist rise was over, and the era of capitalist decline had begin. The chart of output shows the instability of capitalism since that time. The smooth accelerating rise stops, and the course of production becomes a set of the most violent zig-zags, sharp booms and crashes.

The failure of the capitalists to find new markets destroys their old markets and throws the whole system into fierce crises of a new sort, far graver than in the previous period. The era of capitalist decline is the era of capitalist convulsions.

Such is the summary, necessarily oversimplified and sketchy, of the standard Marxian analysis of this ,epoch, and the reasons for calling it the era of capitalist decline. With this background, we can take up the Keynesian proposals, for they are directed toward solving the problem of this stage of capitalism.

The problem appears to the capitalists, and therefore also to the Keynesians, as a lack of opportunities for new investment. Driven by the pressure of billions of uninvested dollars they look around for some substitute for the old-fashioned process of investing in production. Isn’t there some other type of investment that can constitute capitalist wealth? “Yes, there is,” say the Keynesians, “and we have found it. You can invest in government bonds. Your pile of capital assets, in the form of government securities, will grow, just as your ownership of wealth would grow if you built a new factory. The government will spend the money on public works, so the money will stimulate the market, just as if you had spent it for machines for a new factory. Although the special conditions of the period of capitalist youth and growth have gone, the government, by these few measures of central control, can do all that is necessary to restore and maintain capitalist prosperity permanently.”

The question is, can the accumulation of Keynesian wealth, of piles of paper government securities, serve the capitalists as a substitute for accumulation of productive capital? The leading capitalist economists say, “Yes” and so does Henry Wallace. But they base their optimism on a glaring fallacy, a confusion between:

|

Use in producing commodities for sale is the test of the difference between capital goods and consumers’ goods. It is not that capital goods are machines, or that consumers’ goods are non-durable articles like food or clothing. An oil burning furnace in a home is a machine. It provides heat, just as food provides nourishment, but it does not serve in producing commodities for sale at a profit, so it is not capital. A million dollar bombing plane or a ten million dollar battleship is a machine, it provides military enforcement, but it does not serve in producing commodities for sale, so it is classified as consumers’ goods and not capital investment. The money spent for it is gone financially, unlike money spent for capital goods, which is due to return from the sales of produced commodities.

But suppose the government sells bonds for military expenses. The clothing manufacturer in our illustration, lacking a promising opportunity to invest in a new factory, takes some surplus funds and loans them to the government, although he calls it “investing“ in government bonds. He expects return of his money, with interest. With the money the government buys a bombing plane, bombs, etc. Now the money is spent on consumers’ goods and financially gone. If the bombs are exploded or the plane shot down that only dramatizes the fact. If the plane survives it still does not produce commodities for sale to pay off the bond. Where is the wealth that the bond should represent? Marx called such pieces of paper “fictitious capital.”

Trotsky explained this process in the following way:

When a government issues a loan for productive purposes, say, for the Suez Canal, behind the particular government bonds there is a corresponding real value. The Suez Canal supplies passageway for ships, collects tolls, provides revenue, and, in general, participates in economic life. But when a government floats war loans, the values mobilized by means of these loans are subjected to destruction, and in the process additional values are obliterated. Meanwhile, the war bonds remain in the citizens’ pockets and portfolios. The state owes hundreds of billions. These hundreds of billions exist as paper wealth in the pockets of those who made loans to the government. But where are the real billions? They no longer exist. They have been burned. They have been destroyed. What can the owner of these securities hope for? If he happens to be a Frenchman, he hopes that France will be able to wring billions out of German hides, and pay him. (First Five Years of the Communist International, Vol.1, p.185)

What is the effect on the economic system when accumulation of paper claims is substituted for accumulation of real capital? Real investment in capital equipment has a double effect: On the one hand it stimulates economic activity, putting money into circulation through the purchase of machinery and other commodities. On the other hand, it increases the real wealth of the capitalist, by increasing his ownership of profitable productive equipment, and this gives him the motive for spending his money in investment. How does fictitious investment in unproductive paper claims compare with respect to these two effects?

Regarding stimulation of economic activity, the effect of fictitious investment is the same as that of real investment, at the beginning. True, there is a fearful reaction later. But the first effect is genuine stimulation, and this can be very important. A million dollars spent stimulates business just as much whether the manufacturer spends it for sewing machines or the government borrows it and spends it for airplanes, or public works such as parks, or for unemployment relief.

After the First World War the European governments by issuing fictitious capital managed to create an artificial economic revival. In spite of its artificial character, Trotsky pointed out:

The fictitious postwar boom had, however, great political consequences. There is some justification for saying that it saved the bourgeoisie. Had the demobilized workers from the very beginning run up against unemployment, against living standards even lower than before the war, it might have led to consequences fatal to the bourgeoisie. (First Five Years, p.203)

How do matters stand as to the second effect; the increase of the real wealth of the capitalists? Here fictitious capital not only fails to provide the promised growth of wealth, it reacts against its creators.

After a fictitious investment, the wealth is gone and only a piece of paper remains. How does the government pay on it? By levying taxes on production which is carried on with real capital. For instance, it taxes the income from the clothing manufacturer’s sales. But the clothing manufacturer already has a claim on that income, to pay on his investment in the factory. The government bond comes along as a duplicate claim on the same old productive capital.

Fictitious capital is not an asset, but a parasitic claim which fastens on real capital. For the capitalist class as a whole, fictitious capital is not an increase in wealth, but an increased burden on what they already own. It leads to a struggle between groups of capitalists to see which of them can push the burden on the other group’s capital, “to wring billions out of German hides.”

For the whole capitalist class, the intensified effort to squeeze more out of production means squeezing it out of the workers, paying less wages to leave more for taxes to pay the holders of government paper.

Of course a large fund of real capital can stand a small drain. That’s why in the past governments were able to pay on their bonds. As long as he gets his payments the individual capitalist can see no difference between collecting profits from production or collecting interests from a government loan. But, as Marx pointed out, to shift the bulk of capital from production to parasitism is another matter:

This is practically correct for the individual capitalist. He has the choice, whether he wants to invest his capital as an interest-bearing one or as a productive one ... But to make this conception a general one and apply it to the total capital of society, as some vulgar economists do, who even go so far as to regard this capital as the source of profit, is, of course, preposterous. The idea of a conversion of the total capital of a society into money-capital without the existence of people who shall buy and utilize the means of production, which form the total capital with the exception of a relatively small portion existing in the shape of money, is sheer nonsense. It implies the additional nonsense that capital could yield interest on the basis of capitalist production without performing any productive function, in other words, without producing any surplus-value, of which interest would be but a part; that the capitalist mode of production could run its course without any capitalist production. (Capital, Vol.III, pp.443-4)

Would the Keynesian process go so far as to convert the whole capital, or the bulk of the capital of society into interest drawing capital, divorced from production? It will go as far as it can, and it has already gone far. This is fictitious accumulation, trying to substitute for real accumulation. Since it’s a one way growth, it can only operate by getting bigger.

Fictitious capital must be compared with the real capital it seeks to feed on. According to the best estimate, Robert R. Deane’s Anatomy of American Wealth, in 1938, the dollar value of all the man-made capital equipment in the United States was 133 billion dollars. This covers factories, railroads, utilities, business buildings, farm equipment, etc., but not land. All the paper capital, stocks, industrial bonds, mortgages, government bonds, etc., is only an open or concealed claim on this real capital.

The main item of fictitious capital, federal debt, in 1914, was only one billion dollars. When the real expansion stopped fictitious expansion set in, until today the federal debt is near 300 billion dollars and still going up. And this in the most favored of capitalist powers!

Part of this is goods blown up in the First World War. Another part comes from government spending during the depression to create a market. Together those put the federal debt to around 50 billion – a colossal quantity of vanished wealth. The remaining 250 billion was destroyed in waging World War II.

What remains is 300 billion dollars of parasitic claims, seeking to draw from the approximately 133 billions of real capital probably considerably greater now, in competition against the claims of the owners. Such a drain on production must lead to a fierce pressure for lower wages and higher prices, exactly the opposite of the high-wage prosperity promised by Wallace, Murray, Beveridge and Keynes.

Their proposal for further fictitious accumulation is set forth as a “Nation’s Budget.” This is an estimate of the desired level of all economic activity, consumer spending, business investment spending, etc., as well as government activity. This is what the Board of Experts created by the Murray bill will draw up.

The Nation’s Budget recommended in Wallace’s book sets forth a desired level for business. Investment of 30 billion dollars per year, every year, in capital construction to provide the widely advertised 60 million jobs. It is clear that Wallace ought to call his book 30 Billions Capital instead of 60 Million Jobs.

In America’s record investment year, 1929, capital investment came to about 5 billion dollars, or one-sixth of the rate Wallace proposes for growth of capitalist wealth. Wallace incorrectly describes his 30 billion a year goal as only two times the 1929 rate of capital formation, instead of six times. He reports capital investment in 1929 as 18 billion dollars, rather than five billion, but he chooses the wrong figure. American capitalists saved something close to 18 billions in 1929 and wanted to invest it. But the consumer markets, even in those boom days, justified less than five billion of real equipment construction. The rest of their savings could find no outlet but speculation: the stock market boom, the Florida land boom, and other crash-bait. (See the Brookings Institute’s Income and Economic Progress, pp.44 and 174-5.) It is typical of Wallace’s Keynesian outlook that his statistics report the desires of the capitalists, rather than the actual course of production.

We can now see that Wallace’s estimates are truly breathtaking. The productive plant owned by American capitalists now stands at say, approximately 133 billion. By adding to it 30 billions a year they would double it in 4½ years, and triple it in nine. In nine years, by 1955, they would possess three Detroits, three steel and coal industries, three textile and clothing industries, three agricultures, three of everything, all producing. American capitalists are trying to take over the world to give a market for one United States. Where would they sell the commodities from three? And of course they won’t and they can’t build the new factories unless there is a market for the extra commodities.

So, in fact, there will not be this capital construction. But Wallace doesn’t pause. The Nation’s Budget is just a guarantee of what the capitalists are to be given one way or another. The Board of Experts will also draw up an estimate for each year of what probably will be spent, including what business probably will invest in capital construction. That will be less. (For 1929, for instance, the probable business investment would have been 25 billion less than the Wallace guarantee of 30 billions.) Then – Then, and this is the heart of the whole plan, the government is to make up the difference.

Thus the plan is to provide fictitious accumulation when real accumulation fails. What the capitalists can’t invest in factories will be given an outlet in government securities, and the government will spend it in public works to “produce the necessary total national production.” And the mountain of parasite paper will mount.

Always that hungry mass of debt claims keeps growing, and the Keynesians have to explain it away. They do it by confusing real and fictitious wealth. They call the papers “assets.” The debt is no real debt for the nation, they say, because a debt is also some American’s asset, unless it’s an external debt, owed to foreigners. If I owe a hundred, I’m that much in the hole, but the other man has my written promise to pay, which is a hundred dollar asset. He is ahead as much as I’m behind, so the nation as a whole is just even, which cancels the debt as a national burden.

Of course this is false. A paper is never an asset, only a claim. Real goods are assets. If I bought consumers’ goods with the hundred I borrowed, and consumed them, then the wealth is gone. To pay the claim I must work and produce goods, and deliver goods or money that will buy goods to the holder of the promise. Then he will have assets for his claim. Until I do that there is no wealth or asset for the claim. If economic conditions won’t let me find employment and produce goods there never will be wealth for the claim. The federal debt is a memorial to 300 billion dollars of wealth consumed and gone, and it is not anybody’s asset.

Trotsky pointed out that fictitious capital “tends to give an incredibly distorted picture of society and modern economy as a whole. The poorer this economy becomes, all the richer is the image reflected by this mirror of fictitious capital.” That incredible distortion is the stock in trade of Keynesian economics. Unlimited growth of debt suits the Keynesians, since accumulation is their object. Professor Alvin Hansen of Harvard, prominent Keynesian and federal economic adviser, makes no bones about it:

The attack on chronic unemployment by means of public expenditures financed by a continually rising public debt is essentially a conservative proposal.

Even if the public expenditures are for munitions to be burned in war that makes no difference. Hear Prof. Hansen again, on their doctrine that debts are canceled by being assets also:

We shall come out of the war debt free. We shall have no external debt, only an internal debt.

This indifference to destruction of real wealth was expressed most pointedly by John Maynard Keynes himself, who boasted in an article in the New Republic of July 29, 1940, that out of World War II “good might come from evil,” because war conditions would make it politically possible “for a capitalist democracy to organize expenditures on the scale necessary to make the grand experiment which would prove my case.”

Sure enough, the expenditure was organized, and today Lord Keynes, director of the Bank of England, presides in person over his “grand experiment.” The joint stock banks of England are brimming with Keynesian wealth; ninety per cent of their “assets” are government paper, compared to ten to fifteen per cent before the war. In spite of these riches Keynes must go to the United States to negotiate a loan to buy commodities. England’s poverty is so desperate that Keynes must consent to strip her of trade protections, leaving the markets of the British empire at the disposal of United States imperialism, in return for a mere three and three-quarter billion dollars of commodities!

Meanwhile, why aren’t the American capitalists smiling in satiated contentment over their own 300 billions of Keynesian wealth, most of it accumulated from the “grand experiment”? Why aren’t they glorying in being debt free-Alvin Hansen style? Instead, the burden of fictitious capital is an important part of the goad that drives them to sacrifice even their allied British and European capitalism in the search for real capital and real markets to feed their parasite paper claims.

After the First World War, when it still possessed an unburdened accumulated capital, American capitalism was a little less hungry. It was eager to subordinate and exploit, but did not feel compelled to eliminate Europe. But a quarter century of the era of capitalist decline has steadily used up the leeway that American capitalism once had. Today the United States must drive out all competitors.

At home this advanced state of capitalist decline dooms the Wallace-Murray program even as a temporary aid to employment. It is true that fictitious accumulation in its first stage stimulates the economic system. But in the second stage it turns into its opposite and chokes the economic system.

Marx called capitalist spokesmen like Keynes “vulgar economists.” These capitalist apologists don’t look for scientific principles; they merely supply excuses for whatever the capitalist class already is doing. Fictitious accumulation had been adopted by capitalism on a large scale for over two decades before Keynes wrote his General Theory in 1936. Trotsky was pointing out the effects of the device in 1921. Today, Wallace and Murray come out with a proposal to inaugurate this method, after it has already loaded immense burdens on the workers of the nation and the world and has proved its worthlessness.

Thus we see the facts completely expose the promise that by manipulating fictitious capital, the capitalists can stabilize the system even for themselves. Capitalism has demonstrated that it cannot “smooth out” business crises, cannot soften the jagged zig-zags of boom and bust that have always cursed capitalism, but on a more terrible scale in this era of decline. And it must be remembered that these jagged zig-zags were mitigated by the manipulation of fictitious capital. That is all the capitalists could accomplish even by reckless use of this suicidal device, in its first, best period.

In the future it can’t even give the past results. At first it was possible for capitalism to rescue itself and ward off rebellious sentiments among the workers by sacrificing from its store of fat, by allowing an extra load on its unburdened capital. Today, in contrast, the capital has been burdened, doubly and triply. There is no fat to spare.

Main FI Index | Main Newspaper Index

Encyclopedia of Trotskyism | Marxists’ Internet Archive

This work is in the Public Domain under the Creative Commons Common Deed. You can freely copy, distribute and display this work; as well as make derivative and commercial works. Please credit the Encyclopedia of Trotskism On-Line as your source, include the url to this work, and note any of the transcribers, editors & proofreaders above.

Last updated on 9.2.2009