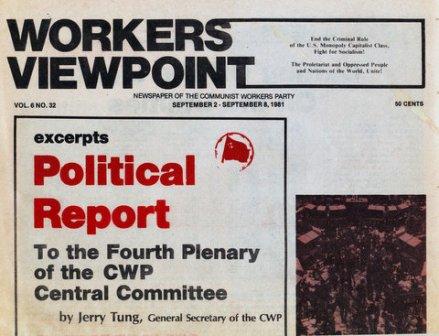

First Published: Workers Viewpoint, Vol. 6, No. 32, September 2-8, 1981.

Transcription, Editing and Markup: Paul Saba

Copyright: This work is in the Public Domain under the Creative Commons Common Deed. You can freely copy, distribute and display this work; as well as make derivative and commercial works. Please credit the Encyclopedia of Anti-Revisionism On-Line as your source, include the url to this work, and note any of the transcribers, editors & proofreaders above.

The economic situation in the U.S. today is characterized by a sort of “deflation.” This is not real deflation because inflation is not being eliminated. The basic inflation rate in this country is around 10-11% and will remain so.

But right now the Federal Reserve and the bourgeoisie are implementing a tight monetary policy to forcefully limit the money supply, induce recession and cool the economy down.

The prime interest rate has been above 17% for well over six months now and will stay there for the rest of the year. This is the highest interest rate sustained for the longest period ever in the capitalist world.

This particular scenario of the economic crisis is something that we had not foreseen at the time of the Founding Congress. We had assumed that the economic crisis would primarily take the form of hyperinflation. Actually there are 3 possible scenarios. One is hyperinflation, another is real deflation, and the third is the continuation of the same stagflation. Now in the main, short of a crash due to hyperinflation or deflation, or a major dislocation leading to the total disruption of the productive forces in this country, the scenario is continuing stagflation. However, the bourgeoisie is consciously steering this stagflation more in the direction of stagnation in order to offset inflation.

This policy is a consequence of the bond market crash several months ago, which we reported in the Workers Viewpoint. We treated it as the most significant manifestation of the economic crisis since the 1929 crash. It is now becoming clear that the significance of the bond market crash is that the U.S. economy can no longer take rates of inflation higher than 20-25% for more than a few months at a time.

The face value of bonds on the U.S. market today is three times the value of all stocks. Bonds are issued by the different levels of government to raise capital for various federal, state or local projects. They are also issued by private industry to raise funds for long term projects such as buying plant equipment, or building roads or railroads – projects which would require decades to pay for themselves. Bonds typically mature in 10, 20, or even 30 years.

The reason the bond market crashed is that people know that with inflation at 20% a long-term investment is too vulnerable to crisis and breakdowns. Anything can happen in the next 10, 20, 30 years. People want to put their money into things that have immediate returns, such as money funds or various kinds of speculative activities where they can get their money back in a matter of months or even days.

One of the things we did not understand clearly before is that the U.S. economy, with its highly developed productive forces, and the sophisticated, long established bond market which financed the development of those productive forces, simply cannot devalue or debase its currency as third world countries, or even war-based economies like Israel’s can. In these countries, where the market does not include such a heavy volume of long term financing bonds, the majority of financial trading is in stocks representing only the immediate value of the various companies. In these cases, the currency can be debased by printing new currency and setting up an exchange, for example, of ten old dollars for one new dollar. But in advanced capitalist economies such as the U.S., Europe and Japan where the bond markets are thoroughly developed, debasing the currency would lead to a total collapse of the economy.

This is also why the scenario of a breakdown through continous hyperinflation is metaphysical and onesided. The reality that the bond market crash has shown us is that there is a limit to how much inflation can be sustained in an advanced capitalist country. And that there is a limit structured in. When the limit is reached, the only way to save the bond market from total collapse is to put a brake on inflation. That is why Paul Volker, chairman of the Federal Reserve, started implementing a very tight monetary policy in October 1979. That is why the last two years have seen a tightening of credit unequalled in the period since World War II. Mortgages are the highest ever, averaging close to 17 percent. Personal credit is hard to get. It’s nearly impossible to get bank loans.

However, because of the relative independence of finance capitalism, trying to slow down inflation is difficult. Due to speculation, the price of things like housing and other commodities has increased dramatically. Since the real value of these things has remained the same, the surge in prices has created a greater demand for money, and there’s much circulation of a higher volume of money through the economy. As a result, inflation increases, nevertheless, despite the bourgeoisie’s attempt to tighten up the monetary supply.

By slamming the brakes on the nation’s money supply over the past year or so the Federal Reserve has finally been able to begin cooling down speculation. This fact, along with the slower rise in gasoline and food prices, has slowed inflation to about 10 percent. Yet interest rates remain in the 17-20 percent range. This shows the bourgeoisie’s lack of confidence that inflation will continue to drop. They know the recent dip is only temporary and that there’s a liquidity crisis structured into the economy. And what this means is that the scarcity of goods and the high volume of money that has been developed by decades of Keynesian economics is trying to realize itself.

One of the reasons we have said that the 1930’s economic crisis was not as extensive as the present one is precisely that the 30’s crisis was triggered off by the collapse of the 10 percent margin of the pyramid in the stock market. But right now, this playing by margin has extended beyond just the stock market to every home in America, and to every level of government – county, city, state, and federal. All sectors of the economy are deeply in debt. In fact, ever since World War II, from the Truman Administration to Reagan’s, the U.S. government has piled up its deficits. U.S. state monopoly capitalism has increased its spending by 270 times. And credit in the private corporate sector has also grown rapidly.

The liquidity crisis, and at the same time the high vulnerability of various businesses, shows that fundamental economic crisis is trying to realize itself. One of the forms this takes is that small and medium businesses are either going under or being swallowed by big businesses. Most businesses in the coming years will have problems financing their day to day activities, inventories, and production. They really have no chance in hell.

For the last 30 years, business in this country has run on credit. Capitalists don’t really need a lot of capital to start a business. They use a small amount of capital to leverage a tremendous amount of credit. It is through this credit that business is done. However, they then have to prepay it day to day, and to pay the cost of the credit. But because of the impoverishment of the American people, and the crisis of relative overproduction (for example, because people cannot afford to buy anymore, goods are stocked up and not sold), the capitalists are no longer able to pay their debts. The auto industry is more complicated because there you have competition, foreign markets. Foreign auto with superior technology is competing with U.S. auto. But this applies to all sectors of the U.S. economy with the exception of oil.

Right now, small business is going under. Annually three-fourths of all small businesses don’t make it. Over a long period of time, 95 percent of all small businesses fold. Small businesses either can’t get credit or even if they do start their businesses, they can’t repay their debts. There is a process of very rapid consolidation going on. Even Wall Street brokerage firms are being consolidated by larger insurance and brokerage houses.

In the past, savings banks issued large amounts of credit, particularly 7 and 8 percent mortgages. Now they are paying 14 to 15 percent to the Federal government. The savings banks are losing, and as a result, the savings and loans institutions are collapsing. About 80 percent of the savings and loans institutions will be forced into bankruptcy or will be taken over by others through mergers. That’s the process of consolidation going on right now. You also see a lot of larger merger motions.

The key to the merger epidemic is the question of liquidity. The companies that are taking over other companies are generally the insurance companies, brokerage firms, and oil corporations. The oil monopolies are very liquid– they have a lot of ready cash. Oil and gas are commodities which are very liquid. You can sell them right away and take over other companies. That’s because credit is so hard to get. The whole new ball game is: the more cash you have (the less credit you owe) the better chance you have to survive and to take over other companies. This is one of the major side effects of the liquidity crisis and the deflation policies of the bourgeoisie.

This is a variation from the hyperinflation scenario that we talked about two years ago. It is the continuation of the economic crisis, and in fact, a more severe and more extensive economic crisis. The class effect of this variation of economic crisis is very high unemployment. The unemployment rate during the 30’s depression was only 25 percent. The soup lines you see in pictures were basically background to that 25 percent unemployment. Today the social structure is different. There is a permanent unemployed strata of youth and elderly workers. Among minority youth the unemployment rate is already 25 percent, and even up to 50 percent for Afro-American youth.

The bourgeoisie’s deflation policy is sacrificing a lot of businesses (mostly small and medium ones) in order to save the bond market and prevent the collapse of the entire industrial base. But 70 percent of the workers in this country are hired by small businesses. This means unemployment will go up a lot higher. The official unemployment rate, this is the people who are still drawing unemployment checks, could go up to 25 percent in a couple of years.

That’s not all. In order to get out of the economic slump caused by “deflation,” sooner or later (probably in about two years) the government will have to relax its controls over the monetary supply. The collapse of too many businesses, and the increase in rebellions due to excessive unemployment, will eventually force the bourgeoisie to try to revive the economy once more. But this will only fuel inflation again, and the continued high interest rates in the financial market are clear testimony of what that sector of the bourgeoisie anticipates will happen. We can expect inflation on a higher level than before – above 20 percent again, with interest rates rising above 30 percent at least temporarily. Long term financing will simply be unavailable at those rates, and even large corporations will go under. Government deficits also will go still higher.

In other words, attempts to get out of recession will fuel another round of inflation. That is how volatile the economy is. And that is why the U.S. and the whole Western capitalist world is running out of options.

In the third year of Reagan’s Administration there will be a high rate of unemployment and very high inflation. As a whole the economic crisis will be on a lot higher level than under the Carter’s Administration. Politically the conclusion will become obvious, that Reaganomics will not work. Even Senator Baker, one of the most racist and hawkish senators right now and the minority leader in the Senate, has said that Reaganomics is nothing but “a riverboat gamble.”

One way to make Reaganomics work is the tax cut. But right now the Reagan Administration’s deficit is already much higher than was the Carter Administration’s. Carter’s projected deficit was $25 billion. Under Reagan’s Administration, despite all the cuts in social services, the deficit at this point is already over $60 billion. Reagan’s deficit is more than twice Carter’s because he’s a high spender in the military area. It is no wonder that Wall St. and the spontaneous market have no faith in Reagan’s “deflationary” policy.

Reagan’s policy is three pronged: (1) budget cut; (2) tax cut; and (3) military spending.

Military spending is designed to back up American foreign policy so that the U.S. can continue to exploit other countries, especially in the face of a politically more independent third world and the Soviet Union. At die same time, one third of the jobs in this country is either directly or indirectly related to the government and government contracts. That itself keeps the country working. That’s the military aspect.

One way to revive the economy and at the same time to cut down inflation is to increase productivity, increase investment in real production and, most fundamental, the masses’ purchasing power. The tax cuts favor die rich, reagan hopes the rich will reinvest their tax savings. Investment would lead to more production. As a result, more goods would be produced, and more jobs would be available. This, Reagan hopes, would create more consumption power – the ability for workers to absorb back the goods – and there would be more goods while the money supply would be limited. As a result, inflation caused by less useful goods compared to money would go down. That’s Reagan’s philosophy on tax cuts.

But as Baker put it, this is nothing more than “a riverboat gamble.” Most of the money saved by the bourgeoisie will not be put back into stocks and bonds (i.e., into production). You can see that in the depressed stock and bond market now. They will put then-money into speculative activities or money funds, which are safer and have a faster return on investment than production. So the assumption that the tax cut money will go into reinvestment in the productive sector and create more jobs and more goods is a pipe dream.

A second problem with the tax cut is that, although they’re hiding the immediate impact of it through bookkeeping tricks, after 1984 the tremendous deficit will be felt. They’ll try to average out the deficit from tax cuts over a period of years, and they’re doing it in such a way that it won’t be felt during Reagan’s election year. But right after 1984 the chickens will be coming home to roost. Inflation will go up like crazy because suddenly the deficit will jump many times, making Johnson’s and Carter’s deficits look like nothing.

There is sufficient indication on Wall Street today – in the suppressed character of the bond market (i.e., the lack of confidence in long term investments) and the continuing high interest rates – that Reagan has already lost the “riverboat gamble.” In the last few days the U.S. Treasury’s 5 to 6-year bonds went to record heights of close to 15 percent, while the bonds of some of the larger utility companies are at 17 percent. Those are the Triple A-type bonds. Even the broker’s loan went over 20 percent; and the prime rate is staying up in the 20 percent range. What this means is that the market (i.e., the finance capitalists) doesn’t believe Reaganomics will work. In fact, the spontaneous market is predicting disaster.

What other political implications are there besides the implication of high unemployment? I think the second one is that in two years there will be higher inflation, a lot higher than what we’ve seen.

The third implication is that the petty bourgeoisie is becoming a class that we can increasingly unite with, even though they will withdraw themselves into tighter and tighter survivalist types of things. The Klan and Nazis – the bourgeoisie will try to use them to become the backbone of a fascist movement in this country. But the economic basis for us to unite with the petty bourgeoisie, particularly small farmers and shopowners, is actually a lot better than before.

The Ottawa summit conference of the Big Seven imperialist countries shows this. In the 70s, the inter-imperialist contradictions stepped up because of the weakening of U.S. hegemony in many parts of the world. The European countries differ with the U.S., for example, on the question of the PLO. They recognize the PLO. The European countries urge detente with the Soviet Union to create a better atmosphere for them to trade with the Soviets, as well as to defend themselves – to get the pressure off their borders. Of course there is a classic contradiction economically, between the U.S. and the second world, in terms of contention for markets. In the era of imperialism, this mainly takes the form of export of capital. But the new feature of imperialism is the question of interest rates. Because the U.S. cannot beat Japan and Europe in technology and quality of products, the higher form of contention now is over interest rates.

In the past, when the U.S. could not beat the second world countries on the commodities produced, the U.S. would just join them and invest in Europe and Japan. The new feature is that the U.S. is pulling its investment out of the second world, again due to the interest rate. The U.S. dollar had declined over the last 10-15 years because of Nixon’s dissociation of the U.S. dollar from the gold standard, and later on, the breaking down of the Bretton Woods agreement which pegged the dollar to other currencies. In the last few years, the U.S. dollar has not been pegged to the other currencies in terms of the limits of the fixed rate of exchange. Now all currencies are floating. This again weakens the dollar, an economic symbol and basis of U.S. hegemony in world affairs.

Now the U.S. dollar is back on top. It’s not because U.S. imperialism has suddenly developed greater productivity. On the contrary, it’s weaker than ever before. Rather, this has happened because of the tight money market, the tight money policy and the U.S. Federal Reserve pushing a high interest rate. The European, Japanese and American investors are pulling money out of Europe and Japan back to the U.S. because it is a lot safer and gets a 20 percent return. They would rather do this than risk investing in European and Japanese industries. Instead of capital export, there is a temporary phenomenon of capital coming back to the U.S. However, this capital is not used to invest in productive industries as the export of capital often is. It is parasitic, used, for example, for speculation on the money market. This has hurt Canada the greatest. The Canadian dollar has come down to its lowest point ever; it is worth 80 cents for every U.S. dollar, and it was a very rapid drop.

At the summit, the main concern raised by the European and Japanese leaders was how the U.S. high interest rate was hurting them. There is no way the U.S. can give in on this question because they have no control over the renewed danger of the U.S. bond market collapsing. As a result, the contradiction becomes sharper. After the summit meeting, West Germany cut their real defense spending by 10%, contrary to U.S. wishes to raise their spending as a frontline state against Soviet pressure. The U.S. also wants the European countries to be less dependent on energy from the Soviet Union. That was one item on the summit agenda which the U.S. tried to use to wrest concessions from the other countries. But’ afterward, the Soviet-West German gas line deal was finalized. This is as strong a rebuttal as the Europeans can give to the U.S. for its monetary policy, which is also independent of its will.

The long term U.S. Treasury bond rate indicates that the U.S. interest rate is not about to come down in the next 5-10 years. This will have a disastrous effect, not only on the U.S. economy – and its small and even larger businesses – but also on the European and Japanese economies which have smaller businesses.

Japan’s prime rate is only four to five percent. France’s and Germany’s prime rate also is much lower – about half that of the U.S. The reason they can keep the interest rate so low is because Keynesian economics in Europe and Japan, particularly in Japan, has been more developed than in the U.S. They are even more susceptible to crisis due to being more heavily dependent on borrowing. In other words, the role of state monopoly capitalism in the second world is larger and more thoroughgoing than here. The way they get the economy and even foreign trade going is to borrow, in the form of government subsidies and from the much more centralized monopoly capitalist groupings like Japan’s Mitsubishi.

The danger of a trade war has taken a new form. It’s no longer just dumping commodities. In a way, the U.S. is getting back at them by jacking up interest rates. Not only is the U.S. exporting inflation as they did before with the inflated dollar. But now, with the higher interest rate and the higher exchange rate for the dollar, it is draining money away from Europe and Japan, thus depressing their economies and forcing them to be more parasitic. This is a new feature of the same old inter-imperialist contradiction.

Politically, instances like West Germany’s policy toward the Soviet Union after the summit and France’s policy toward El Salvador mean that these countries will steer a more independent course in foreign policy, and away from the U.S. In some instances, they will move closer towards the Soviet Union, in other cases they will ally with each other and with third world countries.

What about the effect of this particular form of economic crisis on third world countries? What are the political implications?

The biggest infight within the U.S. bourgeoisie has been over the question of the International Monetary Fund and the World Bank, over whether the budget for the World Bank should be cut down in view of Reagan’s slashing all other budgets. Robert McNamara came out strongly against it. He said the people who don’t want to allocate money are basically ignorant. He’s right! The excess dollars printed during the Keynesian period in the last 30 years need to be “recycled” by lending them to third world countries. This has two effects. One, it keeps the U.S. inflation rate down and strengthens the dollar internationally. Two, it is used for economic control (neo-colonialism). Ever since the U.S. was defeated in Vietnam, it became clear that the U.S. could not contain the rise of third world countries and communism by brute force. Since third world countries have a slow rate of capital accumulation and formation and have weak economic and agricultural foundations, they need a lot of capital and are thus very susceptible to this form of control.

The economic relationship (i.e., trade and finance) between imperialism and third world countries is unequal. Therefore that kind of money-lending does not lead to the development of real productive forces. In fact, in most third world countries, this kind of investment is used to siphon off their natural resources and make them more dependent technologically on western goods. As a result, more third world countries are unable to pay back the loans to the World Bank. Defaults by Brazil, Argentina, or even Poland can lead to a collapse of one of the two biggest pillars of the U.S. dollar, the recycling of dollars in third world countries.

This episode reveals again that Reagan is short-sighted. No, it’s not a conspiracy among the bourgeoisie as a whole; there’s no one think tank with a unified policy behind it. Rather there are different interests and think tanks and the bourgeoisie’s ruling coalition picks what seems to them the most expedient policy.

Reagan wants to slash the budget. He even wants to chop the money for the World Bank. That will lead to collapse right away. The struggle gets really sharp and the mainstream bourgeoisie is able to sway Reagan into not cutting the World Bank, but in fact, into increasing its budget. The article on the International Monetary Fund in The 80s (October 1980) talked about how using that kind of trick to delay the impact on the U.S. will actually make the problem more extensive. The world economy, because of imperialism, is a lot more vulnerable to crisis. Default in any part of the world can trigger a total collapse. Even though in most cases they will extend the deadline on the loans, or re-finance them, there’s really no way out. The institutions that are affected by western imperialist countries, like the World Bank, become more vulnerable to crisis. That’s why in Poland, the offer to extend credit and renegotiate the debts by U.S. imperialism is far from being a concession. Actually, it’s independent of the will of the western countries to lend the Polish government more money through the debt-serving of existing through the debt-serving of existing loans. The economic and monetary problems of imperialism become more widespread and extensive. Overall this leads to a greater susceptibility to any crisis that can trigger it off. That’s another feature in the 80s which didn’t exist in the 30s.

The U.S. bourgeoisie tries to peg the IMF and World Bank’s funding pool and credit to OPEC dollars so as to decrease its vulnerability. That is still the largest pool of money that can shore up the IMF in case there’s a crisis. Politically, that means Arab countries will have more say in the IMF. This would contradict U.S. foreign policy toward Israel and the PLO. The Middle East is probably the most vulnerable spot for the U.S. in its relationship to Japan and Europe, because second world countries are so energy-dependent on Mideast oil. The difference arises over how to handle Israel.

Israel itself was set up by the imperialist countries, using Zionists as the local police, as a junior partner to the imperialists. As long as all the Arab countries are lined up against the imperialists, then Israel is necessary. Right now there is a differentiation of class forces within the Arab countries, as the traitor Sadat of Egypt shows. He unilaterally signed an agreement with U.S. imperialism and broke the united front among the Arab countries against imperialism and Zionism. Under Carter’s leadership, the U.S. was able to sign the Camp David agreement. It was significant that it was able to use the threat of the Soviet Union and revolution in Arab countries to drive some of the Arab leadership to align with the U.S. on most of the other issues.

On the other hand, certain factions of Zionists have relative independence. Their bombing of the nuclear reactor in Iraq, the invasion of Lebanon, and other actions have affected the U.S.’s strategic position of using Israel as a junior partner in the region and of coopting some countries towards the U.S. and away from the Soviet Union. Zionist fanaticism has caused a tremendous amount of strategic difficulties for the U.S. There are obvious differences within the U.S. bourgeoisie on how to handle it. This is another item which sharpens the contradiction among the U.S. bourgeoisie. Carter and Brzezinski have come out calling for recognition of the PLO after Sadat’s recent visit to the U.S.

During the second session of the Founding Congress I showed why inter-imperialist contradictions are a condition for the development of a revolutionary situation. When the contradictions sharpen, it means they become entangled among themselves. The more they’re entangled, the harder it will be for them to come down on us with a unified understanding, policy and force. The sharper their contradiction, the more time we have to prepare, given our concrete situation in the U.S. today. It gives the vanguard more time to pull itself together, get the masses ready and use the bourgeois crises to educate the masses.

A lot of comrades believe a lot of the bourgeois press reports about Reagan having a mandate. Especially after his budget cut and tax cut programs went through Congress like a blitz, there’s a feeling that Reagan has succeeded in forming a new coalition and therefore he has unified the main wing of the bourgeoisie and thus the official policies of the mainstream bourgeoisie. Both conceptions are far from the truth. As we said before, he has no mandate. That’s becoming clearer and. clearer. Secondly, in terms of his leadership among the bourgeoisie, it is also becoming obvious that the appearance of his programs blitzing through Congress is far from the truth. In fact, contradictions are developing; for the U.S. presidency, in the hottest; and most rapid way ever in the last several decades.

In order to get his budget cuts and tax cuts passed, Reagan had to steamroll them through. He handled Congress with intimidation and strong-arm tactics. This caused a lot of contradictions to come up, and they are coming up early, inflicting a deep wound among the bourgeoisie. Take, for example, Tip O’Neill’s opposition in the House. This kind of opposition is spreading. A good example is the attempt, barely six months into the Reagan presidency to get rid of one of his cronies, William Casey, the CIA director. Not only were the liberal Democrats behind this, but even conservative Goldwater Mainstream Democrats like Moynihan, who’s in the Senate Intelligence Committee which oversees CIA activities, came out and tried to play on the contradiction. Scoop Jackson, one of the leaders of the Senate Democrats, also supported firing Casey to punish Reagan. Remember Watergate came out in the second, third years of Nixon’s rule. Unlike the Casey controversy, it didn’t become an issue that fast and that early. Nor did the Billy-gate incident during Carter’s administration. It took quite a while to warm up. That’s one signal of the sharpening contradictions. There are many others which show the deep, irreconcilable contradictions among the bourgeoisie. Earlier I talked about the IMF and, in that case, clearly the mainstream bourgeoisie won.

One of the populist conceptions of the Workers World Party is about “right-center-left” in politics. It leads them to think that Haig is a maniac, a fanatic, a “right-winger.” That’s why WWP calls for the impeachment of Haig and kicking him out. That was their main slogan and they tried to make it the main slogan for the May 3 demo. Yes, there is a military-industrial complex and there is a relatively independent interest. But Haig is a mainstream representative of the bourgeoisie. He’s a moderate within the Reagan administration. He represents the mainstream bourgeoisie’s line. For example, on detente, Soviet Union, and SALT III, Haig’s appointees came out with a definite schedule way before Reagan committed himself to it.

They are beginning to change the slogan of their foreign policy from big stick back to the old deceptive slogan of “human rights.” He is starting to put on some cosmetics like punishing the soldiers who killed the nuns in El Salvador. Another, bigger manifestation came out in the difference between Haig and Reagan over China and Taiwan. The bourgeoisie need China to play off the Soviet Union, to keep the Soviet Union off the Mideast and Europe. China is very strategic to the bourgeoisie. They want to tie down and lure the Soviet Union toward China. Haig came out with an agreement to sell weapons to China which is against that policy. Vance came out strongly against Haig, saying that’s a hell of a way to play the China card by revealing your own trump card, and that it would vastly minimize the U.S.’ leverage over the Soviet Union. So this shows clearly – Vance, being one of the old boys from the network of the Council on Foreign Relations, one of the old guard of the blue-blood U.S. bourgeoisie’s line – the sharp differences there. On the question of Taiwan, Haig was negotiating in China, trying to play up the contradiction between China and the Soviet Union. While he was still in Peking airport, Reagan made a statement to the effect of upholding the right of the U.S. to sell arms to Taiwan. This prompted the Chinese foreign ministry to send a protest right to Haig’s airplane in Peking airport, pretty much reversing his efforts during the talks. It’s clear there’s a sharp contradiction.

The Reaganites represent the diehard views towards Taiwan. This shows Reagan doesn’t understand the global view. He doesn’t represent the interest of the whole bourgeoisie in terms of their global interests, in Europe and other places. It’s interesting to observe that Scoop Jackson, who came out strongly on the firing of CIA Casey, represents Boeing in Seattle, Wash. And Boeing right now isn’t getting enough of the military contracts they want. They are still in the main a civilian aircraft manufacturer, about 10 percent of their production is military. McDonnell-Douglas, on the other hand, which has most of its plants in California and the Southwest, represents the interests of certain groups that Reagan historically has in California, the West and the Southwest, and which are tied to the interest of military outfits there. About 85 percent of McDonnell-Douglas’ production and business comes from the government and military hardware. So Scoop Jackson’s opposition to Casey definitely reflects the contradiction there.

The same thing applies to the fruit flies in California. Agribusiness has succeeded in triggering off an incident such that it rolled over Jerry Brown, who has to worry about his populist-liberal image of being environmentally conscious. Again it shows the contradiction among the bourgeoisie with Reagan siding with the Bank of America where he was from originally and where agribusiness controls agriculture.

So in terms of foreign policy, the mainstream bourgeoisie, the Rockefeller camp, worries more about their global interests, like Europe and third world countries. Reagan’s foreign policy has been drifting towards the old Carter foreign policy which would delay the crisis and is more in the long-term interests of the bourgeoisie. So, far from Haig being a right-winger, and the military-industrial complex being in control, there is an infight among them, and it is the mainstream bourgeoisie’s line that is prevailing.

But on the other hand, on the economic front, I think the contradictions are a lot more difficult to resolve. In fact I don’t think even the mainstream bourgeoisie is clear which way out. They are all clear that they need to lower the inflation rate by pumping the brakes on the money supply, even to the extent of leading the country to deeper and deeper stagnation. But there is no agreement on the supply-side policy; that is, the tax cuts.

Although there’s agreement on lowering inflation, in the long-term sense, I think there is still disagreement. For example, Felix Rohatyn, who is a financial genius for the mainstream bourgeoisie, and Kennedy, have all put forward the line of “reindustrialize America,” to get things going. This line is closer to the social-democratic view which is actually more sinister. While they do not openly come out in the long term, there’s no other way to delay the crisis without resorting to more Keynesian financing strategy – by stimulating demand and by state intervention into more and more sectors of U.S. economy to enlarge the realm of U.S. state monopoly capitalism. And they laugh at Reagan’s supply-side laissez-faire capitalism, saying it does not work. And of course it does not work.

Reagan’s intervention into the auto industry, for example, by trying to limit imports, already shows the state intervention. So instead of doing away with state regulation and letting the free market play itself out, Reagan is clearly intervening in the market. And even though Reagan slashed some of the money to develop synfuel energy from the budget, there are increasing signs that he will back it again just like Carter did.

But I think there is a certain wing of the bourgeoisie with ideologues such as Felix Rohatyn, Kennedy and others. They want to give Reagan’s supply-side economics a try although as a whole the bourgeoisie is not clear. Volker is not just a Reaganite. He’s been there since Carter. So they all have agreement on putting a brake on the monetary supply. But in terms of supply-side they are all waiting to see what happens. If it doesn’t work, Reagan will pay for it. People like Rockefeller, Rohatyn and Kennedy are waiting in the wings, watching to see if Reagan’s program will flop and bring about an even greater upsurge of inflation. Then they’ll make a comeback.

And that’s the main basis for the vacuum in 1984. In the third year of Reagan’s presidency, when inflation will go up again in a big way, and supply-side fails, then the Democrats will be ready to come back. There will be a backlash of liberal Democrats who historically represent the interests of the mainstream bourgeoisie. That’s why somebody like Felix Rohatyn is quietly selling his program of reindustrialization and not giving up on that, and defending the long-term interests of the bourgeoisie, waiting in the wings for Reagan’s program to flop.

According to this view, unlike the simplistic view that Reagan represents fascism and fascism is taking over, the dominant bourgeoisie are represented in Reagan’s coalition, even though in most cases the immediate advisors go towards Reagan’s Southwest interest group’s line. But the New Deal so-called “working class” coalition is far from collapsing. The New Deal Roosevelt bourgeoisie, the mainstream bourgeoisie is intact. They transcend party lines. Some of them are Republicans and some are Democrats, or even third party.

So, besides the fact that Reagan does not have a mandate among the masses, there is no realignment among the bourgeoisie. There is only a failure of the old policy. Therefore there is realignment of the old forces, of the old way to play it – represented by a set of liberal policies which manifested themselves in the past 30 years, that is, imperialist-liberal policies. The new alignment, in terms of a stable form that will last for another 10-20 years into another period of capitalist stabilization, will not happen, because fundamentally they have not formed a strategy to deal with that.

But the fact that the old policy has failed and the sharp line drawn between the Democrats and Republicans in the last few months, with Reagan leaning toward the Republicans, does not mean at all that the New Deal bourgeoisie, the bourgeoisie that backed Roosevelt, and the policy which led to the stabilization of capitalism over the past 30 years, has withered away. They are still there. They’re waiting. If he flops then they’ll reassert themselves in another form. In that sense there’s realignment, but that is not real realignment because that is not possible yet. All are watching.

The so-called consensus among the bourgeoisie, so-called Reagan’s success in building a new coalition among the bourgeoisie is only a very superficial phenomenon. In fact, the attempt to fire CIA Director Casey and differences over foreign policy – show the pent-up contradictions that are already heating up only six months into his presidency. That is unprecedented. And it is a feature. We have to differentiate appearance from essence. The essence is that the contradictions are actually sharper than ever before. There’s a lot more that will come out. The fundamental contradictions of capitalism are so sharp and the lack of solution in sight basically reaffirm our five-year framework. It gives us more time.