From The Journal of Political Economy, Vol.12 No.4, September 1904, pp.449-472.

Transcribed & marked up by Einde O’Callaghan for the Marxists’ Internet Archive.

Thanks to Daniel Gaido.

HOW FAR does the conception of marginal units of production assist toward a theory of distribution? It is easily shown that if an unlimited amount of labor is procurable for a business where the other factors of production are given quantities, the last unit brought into employment will receive no aid – or a minimum aid – from the other factors and will take in wages virtually the whole addition to the productivity of the business which follows its employment. This is clearly set forth by Professor Marshall in the illustration of the marginal shepherd. A farmer with a given farm and farming capital calculates that it is just worth while to employ a tenth shepherd, whose addition to his staff enables twenty more sheep to be marketed in a year than would be the case were nine shepherds employed. These twenty sheep must be accredited to the marginal shepherd as the specific product of his labor, and he will receive them, or their value, for his wages. For though he receives the same assistance from the land and capital as the other shepherds do, it is necessary to assume that no more productivity is got out of these factors when ten shepherds are employed than previously when nine were employed; or, put in another way, any assistance the marginal shepherd receives from capital and land is attended by a corresponding shrinkage in the assistance rendered to the other nine. For unless the full economy of the fixed factors were exhausted by the employment of nine shepherds, there would be a surplus gain to the farmer on the employment of the tenth shepherd after paying his wages; in that event it would pay to employ an eleventh shepherd, and the tenth would not be marginal. It is necessary to admit that the marginal shepherd – or, to be more precise, the marginal part of his labor – adds a product which is entirely attributable to his labor and (nearly) the whole of which is returned to him in wages.

Similarly, it is argued, the last unit of capital borrowed for a business, the other factors of which are given quantities, will just produce what must be paid for interest, leaving no margin of profit. If our farmer working a farm with his ten sons finds it is just worth his while to borrow another £100 for working capital, the additional product created must be attributed entirely to this last or marginal unit of capital and leaving only a nominal profit after paying the interest. For though the labor of the farming group co-operates with this last £100 worth of capital, we are obliged to assume that the enlarged capital is less completely utilized than the smaller capital: otherwise there will be some profit from this last £100 of capital which in that case is not really marginal.

If we were to suppose that agricultural land were in the same condition as capital, an unlimited amount being available for renting on the same terms, it is clear that our farming family entering such a country with a given capital would take on a marginal unit of land which would pay as rent the whole of the increased product of the farm due to its use. [1]

Proceeding further, let us suppose a farmer entering agriculture with a given stock of personal ability and enterprise, a pure entrepreneur, able to buy all sorts of productive energy in free and virtually illimitable markets. His increments of productive energy will be composites of land, various forms of capital and labor, varying in composition as he expands the area of his farming operations, whether extensively or intensively; he will buy and apply the units of the various factors according to his estimates of the technical economy of the farming business. The limit to the quantity of each sort of productive energy he buys, and to the aggregate which he will employ, is determined by the economy of the utilization of his given amount of personal power; the last increment of land/labor/capital he takes on will only just pay the rent-wages-interest and will leave a merely nominal surplus-gain for him. But this last or marginal unit of land/labor/capital must be considered just as productive as any oi: the others, and, ex hypothesi, receives the same payment in rent-wages-interest. This payment will exactly cover the product attributable to the specific productivity of each composite unit, and, on our hypothesis of an indefinitely large supply of each factor, we must conclude that each unit of land, capital, and labor receives in payment just what it produces. Our farmer-entrepreneur cannot be exploiting them, for the marginal increment which is as productive as any other increment receives the whole of its product as payment for its use, so therefore must all the earlier increments.

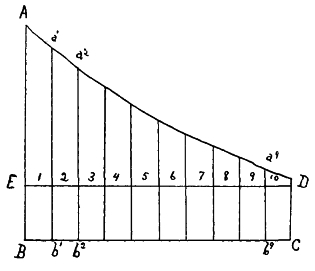

How are we to conceive the profits of our farmer? If there is no surplus in the employment of the last unit, and the last unit is just as productive as any other unit, it would appear that no profit could arise. The ordinary diagrammatic representation of the “dosing” theory does indeed show a surplus derived from the employment of each increment except the marginal one. The familiar figure on the following page runs thus:

|

Here A B represents the entrepreneur’s personal power; to it are added ten increments of land-labor-capital, to which a diminishing amount of productivity is attached, the first unit yielding the figure A B b1 a1, the tenth yielding a9 b9 D C. The marginal increment alone receives in payment virtually its whole product; each of the others yields a surplus receiving the same payment as the last, but affording a larger product. Here the entrepreneur appears to make a large profit on all the earlier increments. But this figure is a most fallacious one, if designed to explain how the aggregate product of the fully organized business is apportioned. For it appears to show that the ten increments are unequally productive, or that they receive unequal amounts of assistance from the energy of the entrepreneur; and neither supposition is warranted. For when there are ten units of land/labor/capital employed by the entrepreneur, if a separate productivity be attributed to each, whether or not that productivity includes the assistance of the entrepreneur, it must be the same for each of the ten.

The diagram as it stands says this: If to the farmer’s ability A B one dose of productive energy B b1 be applied, the product is A B b1 a1; if a second dose be applied, the smaller product a1 b1 b2 a2 must be attributed to it, because, though in itself equally productive, it receives a smaller assistance from A B, So with each subsequent dose: it receives a diminishing amount of assistance from A B, until the tenth dose receives a minimum or negligible assistance. Now, it is evident that we have no right to represent the second dose as receiving less assistance from A B than the first dose, when we are analyzing the composition of a two-dose business; each dose must be supposed to have the same relation to A B. So with the full ten-dose business: the last dose receives the same assistance from A B as is now rendered to the first dose, though of course much smaller than was rendered to the first dose when it was the only dose, or one dose among four. It is folly to retain a diagram which suggests that the product of the first dose is A B b1 a1 when this is only true in the hypothesis that one dose only is applied – a hypothesis which is denied by the application of each subsequent dose.

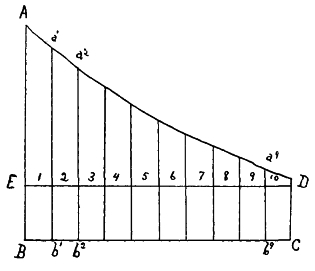

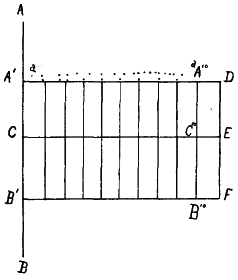

It is clear that, if we are to represent a business in which ten doses yield the maximum economy to the entrepreneur, we must assign an equal productivity as well as equal payment to each dose. Beyond these payments, however, there emerges a surplus claimed by the entrepreneur, as profit or wages of management, which, on the ten-units basis, must appear to have the same relation to each unit. If ten doses be applied to A B, this equality of productivity, payment, and surplus will appear in the following simple figure:

|

The entire product A1 B1 F D is divided by C E into two parts, the lower, C B1 F E, going in ten equal payments to the units of land-labor-capital; the upper, A1 C E D, forming one or ten units of surplus or profit or wages of ability for A B.

But, it will be objected, in this diagram the last unit, which we call marginal, appears to carry, in addition to the product which represents its payment, C10 B10 F E, an extra product or surplus, A10 C10 E D. If the tenth unit be removed, this surplus seems to disappear with it. The existence of such a surplus, however, is excluded by the terms of our hypothesis.

Now, as we have already seen, we are obliged to assume that the aggregate productivity of our entrepreneur reaches its maximum in co-operation with nine units; if then, ten are employed, any assistance it appears to give to the productivity of the tenth implies a corresponding reduction of assistance to the other nine. In other words, on a nine-unit basis in which A10 B10 F D is eliminated, the product associated with each of the nine units is larger than it is found to be after the tenth is added, by the presence of a larger surplus, represented in the diagram by the substitution of the dotted line for the line A1 Al0. The employment of the tenth unit has simply substituted the surplus A10 C10 E D for the nominally smaller surplus a A1 A10 d which existed on the nine-units basis.

If we assume the operation of a law of diminishing returns, it seems self-evident that he will take on just so many units of land-labor-capital at their current price as will exhaust his economy of personal ability, the last unit evoking a merely nominal amount of this personal power. The surplus thus arising will be claimed as the product separately attributable to the entrepreneur’s personal energy and ability. So it appears that each unit of labor, capital, land, gets out of the general product of the business just what that unit produces. And does the entrepreneur get just what his ability produces? It seems as if this were necessarily the case; for, in addition to the land, capital, and labor, the only productive force which remains is his ability; hence, if we take away that part of the entire product due to the three former, what remains must be the product of the latter.

So there can be no exploitation of labor or of capital, and the profits of the entrepreneur, however large they seem, are the specific product of his personal productive energy.

But to this conclusion it will be objected: “Are you not attributing to the productivity of the entrepreneur all the effect of economy of division of labor and co-operation of the units of labor and capital? Are you not paying the several laborers on the basis of their separate productivity as individual workers working without co-operation of other workers and of capital, whereas their aggregate productivity when working under these conditions greatly exceeds the added productivity of their separate labor? Is not the main object of employers in perfecting individual bargains with employees the desire to obtain their labor-power on the reckoning of its productivity as a separate producing unit and then to make it co-operate with other units taking as profit the increase of productivity thus attained? Is it not, on the other hand, the object of labor organizations by ‘collective bargaining’ to obtain for the laborer the equivalent of his productivity as a collective laborer? Similarly with units, of capital: Is not the basis of the economy of a joint-stock corporation the desire to borrow units of capital at rates which are equivalent to their productivity when separately employed, and to raise the value and the yield of these units by employing them collectively? A banking firm manifestly makes its profits largely out of this difference between the productivity of separate bits of capital and that of the same bits used collectively.”

The ability of an entrepreneur is no doubt essential to this economy, but are we at liberty to assume that the whole results of it are attributable to the separate productivity of his ability? The separatist treatment which the close method employs upon the other factors of production expressly serves to exclude from these factors any share in their collective productivity as distinct from their individual productivity, and to impute it to the only agent who functions collectively, viz., the entrepreneur. The fact that the entrepreneur gets no appreciable advantage for himself from the employment of a supposed last unit of other factors is no evidence that he does not get an advantage from the co-operative economy of all the units; the phenomenon of the marginal unit is only another way of expressing the fact that there is in most industries a necessary limit to the area of exploitation of labor and capital by entrepreneur ability. From the standpoint of labor it may mean that there is always a limit to the number of laborers whom an entrepreneur can employ so as to get profit out of their co-operative labor; when this limit is examined, it necessarily appears that a single laborer added or substituted makes no difference to the aggregate of this profit.

It is now evident that in our illustration of the effect of a marginal unit, whether of labor or of capital or of land, or of all three together, we are suffering from a false conception of causation or attribution due to the arbitrary use of constants and variables.

The whole results of the co-operation and division of labor of the other factors of production have been imputed as the exclusive product of the ability of our entrepreneur by assessing separate products for each unit and then assigning to him the entire residue as his product. In the history of the theory of distribution this residual claimant game has been played in various forms. It has already been shown by various writers how the attribution of the residue depends entirely upon which of the factors in production is taken as constant and which as variable.

Of the variations of this game that which takes the entrepreneur as the constant and the other factors as variable is certainly the most conformable to the facts of modern industry. The function of the entrepreneur is to buy the use of units of labor, capital, and land, to organize them for effective production, and to sell the product, so as to get the largest margin of gain. Now, assuming that each unit of labor, capital, and land gets its separate product for its payment, does the surplus which we see remains do more than pay to the entrepreneur the “product” of his productive energy of management? The owner of each unit of labor, capital, and land appears to get just what he produces, and this payment is a minimum necessary cost. Is this the case with the entrepreneur? There is nothing in the setting of the problem, as we have hitherto set it, to place the entrepreneur on the same footing with the owners of the other factors of production, so as to insure that what is taken by him is (a) his specific product, (b) a minimum “cost.” For in this setting the entrepreneur factor has been taken as a constant quantity with which variable quantities of labor-land-capital co-operate. By this method it appears that the three latter receive in payment their product, but it does not follow that the residue, taken by the entrepreneur, corresponds in the same sense with his product. If we are to eliminate the possibility of any entrepreneur’s “unearned” gain, and to place his payment on the same footing with the others, we must remove the “constant” position of the entrepreneur. As we assume that our entrepreneur (A B) was able to purchase an unlimited number of units of labor-capital-land at the same price, so now we must assume an unlimited number of entrepreneurs in the position to buy the other factors.

Professor Clark, whose theory of distribution in a “static” society we are endeavoring to reach, clearly recognizes the necessity of this assumption:

May not all entrepreneurs be making the same rate of net profits and making them at the same time? May there not be a condition of equal and universal profit? Clearly not; for this would be a universal invitation to capitalists to become entrepreneurs, and, as such, to bid against each other for labor and capital, until the profit should everywhere vanish, by being made over to laborers and capitalists in the shape of additions to wages and interest. The pay of each of these agents, therefore, under perfectly free competition, is bound to stand at the productivity level. (p.291, note.)

It is not always quite fully recognized that there are two conditions to a working of industrial society which equalizes the economic position; of the several factors and reduces all their payments to costs. One is complete fluidity between the several grades of each factor, the other is the existence of an unlimited number of units of each factor. The former, indeed, is commonly admitted as that equality of economic opportunity requisite to secure equal rates of interest to different forms of capital and equal net payment of wages to various sorts of labor.

But if industry be regarded as built up out of increments of productive power in entrepreneurs’ ability, labor, capital, and land, and if the condition of remuneration by bare “cost” or “specific productivity “ be that each last or marginal increment receives just what it adds to the total product, this condition can exist only so long as there remains another unit hitherto unemployed. For it is surely evident that if all the units of any one factor of production available for a particular industry are absorbed, while units of the other factors are not absorbed, the marginal increment of the “short” factor will be able to take a scarcity rent, or an addition to the product representing its bare cost. However free the competition within the ranks of each factor, a short supply of any factor as a whole compared with the others enables a scarcity value to arise at the margin, and this value or surplus-pay will be taken by each unit of this factor in use. This is the source of such inequality as exists (a) in the distribution of wealth as between land, labor, capital, ability, regarded generically as factors of production and, (b) in the elevation of the value of some classes of commodities and the depression of other classes, as exhibited in processes of exchange.

In stating his theory of distribution for a “static” community, Professor Clark essays to isolate the static forces by supposing a stoppage of five dynamic forces, increase of population, increase of capital, changes of industrial method, changes of business organization, and growth and change of human wants. But in the “static” community thus reached it is not the case that we should, as Professor Clark avers, reach a condition in which “values are here ‘natural’ in the Ricardian sense, for everything sells at its ‘cost of production’ and no entrepreneur makes a profit.”

For if in a “static” community any one of the factors of production were less abundant than the others, either as regards a particular sort of production or as regards production in general, we should have “net profit” or “scarcity rent,” or some other surplus, which was no cost of production “in the Ricardian sense,” emerging at the margin and upsetting the theory of distribution by “cost.”

On the other hand, if we suppose a “static” community in which none of the factors is relatively short, how can we apply the method of marginal increments in a theory of distribution? So long as we could take a capitalist adding to a fixed capital successive units of labor, or an entrepreneur adding to a fixed quantity of business enterprise successive units of capital and labor, we were able to measure something that could be called the separate productivity of the last unit. But if we take what from the standpoint of distribution is the real condition – a number of units of all the factors of production spontaneously co-operating for the most efficient production – the last increment in such a complex will be composed of all the factors of production, and the knowledge of what it adds to the total product will be of no assistance in determining the productivity of the several factors which constitute this complex unit. All we should know would be that the last unit was as productive as any other unit, and that its owners received the same return for its use. But this is not taught us by experiments with marginal increments; it is an assumption prior to any such experiment. In a static society where a limited production is conducted by co-operation of freely competing and fluid units of labor, land, capital, ability, none of these factors being able to take a “scarcity” rent, speculation and diagrams on marginal units, would teach nothing. For every unit would be ex hypothesi as productive, and as well remunerated, as any other, and every unit would be an indissoluble complex of the several factors of production.

It is quite true that, with complete fluidity of the factors of production and no shortage of any factor, we should get equality in distribution. It might even be said that each unit of each factor would get its “product” in payment for its services. But this statement could not be proved by any “marginal” method, for every marginal unit would be composed of all the factors in such wise that the hypothetical elimination of any one of these would sterilize to an unascertainable extent the others.

Apart from this, the hypothesis of a “static” society in which no single factor was in a condition of shortage, and so able to take a scarcity rent, is a self-contradictory hypothesis. For such a society, containing ex hypothesi a number of unemployed units of each factor, could not remain “static” in any intelligible sense.

As applied to the case of any single industry, the “marginal” method implies a fixed or given supply of some one of the factors and an unrestricted supply of the others. Such an argument may be applied to show that the last increment of the unrestricted factors gets what its presence adds to a complex of productive power in which one portion is restricted, but it cannot show that no surplus accrues to the owner of the restricted factor by virtue of its restriction.

The whole elaborate argument regarding distribution in a “static” society seems to come to this, that under conditions of “free” competition there would be no “marginal” rents; i.e., no payments beyond cost. Under equality of economic opportunity there is equality of distribution; i.e., if everyone has an equal chance of making a gain, gains will be equal.

The marginal unit of labor or of any other factor does not assist us to determine, or even to measure, the part played by labor in the production of wealth due to the co-operation of capital, labor, law, and ability in a so-called static society. It gives us no information not already assumed in the terms of the problem.

If we turn from an illusory static to a real dynamic society, bow far will the method of marginal units assist us then? Taking a farmer with a given quantity of organizing power, a fixed piece of land, and a fixed stock of farming capital, it looks as if we might learn something from the productivity of the tenth or marginal shepherd whom he just finds it worth while to employ. But what do the terms of this experiment imply? The only way of isolating the productivity of the marginal shepherd is to suppose that the farmer used his land, capital, and organized power with nine instead of ten shepherds, that is, to suppose him to be an “uneconomic” man, wasting some of the powers in his other factors of production. If it is better for him to employ the tenth shepherd, it is because by employing him be will make a slightly better use of the other given factors; and here, ex hypothesi, it is not possible to discriminate how much of what is added to the total product can rightly be attributed to the specific productivity of the tenth shepherd and how much to the better functioning of the other factors. Even if, in accordance with our earlier analysis, we take a theoretic margin – that is, the last portion of the tenth shepherd’s labor – as a labor-unit whose productivity gets no use out of the other factors, it is only by an empty mathematical abstraction that we appear to obtain any information out of this use of margins. This margin will be an undetermined or strictly an infinitesimal fraction of a determined and known unit of labor-power; if we attribute to such a margin a separate productivity, arising from the use of labor alone, this productivity will be equally undetermined and cannot assist us to know what is the specific product of the labor of the marginal shepherd as a whole. [3]

If we assume that a farmer has been employing nine shepherds where he ought to have been employing ten, and we let him add a tenth, and ascribe the increased product which covers an improved use of all the factors of production to this last unit of labor, we are arguing in a quite unwarrantable way. Our real farmer, as an entrepreneur, capable of borrowing units of capital and of renting or buying land as well as of hiring labor, at given prices, must be conceived to put the following question to himself as he plans the most profitable use of his skill and experience: “How many shepherds shall I employ to how many acres of land, and how many £100 worth of farm capital of various concrete kinds?” He will not consider doses of labor except in organic relation to doses of land and capital. His real doses will be composite doses of farming-power, composed in varying proportions of the several factors, and no dose will be considered to have a separate productive value apart from the others with which it will co-operate, so as to give a fuller utilization of the productive powers of the whole farm under his management. He will never be able to say truly, “My last shepherd is worth to me so many sheep,” any more than he can truly say. “My last £100 spent in fencing is worth so many more sheep.” If he does use such language, it will always be that he wrongly attributes to the new man, or the last piece of fencing, the entire economy of rectifying the waste of general productive power involved in an earlier mismanagement or neglect.

If a truly economical farmer takes on more labor he will either require more capital or more land, or else will be changing his whole method of production to meet some change in the market. Even if he takes on no more land or capital, the reorganization of his labor-force accompanying the increase of employment will preclude him from attributing to the new labor the entire value of the increased product, or any assignable proportion as its exclusive or specific yield. Even on a sheep-farm, a less complex business than most, it is not possible to ascribe any given number of sheep to one shepherd as his product, irrespective of other expenses.

Turn to any ordinary modern industry, and it becomes at once apparent that the problem is, one of an organic amalgam of productive powers which does not permit the attribution of a separate productivity either to the separate factors or to a marginal unit of composite productive power. A firm enlarging or contracting its business has closely to consider the net effect of such change on (a) its gross profits, and (b) its net profits; but such changes can never affect one factor exclusively.

So economists can watch the expansion or contraction of an entire industry, or of the trade of a country as a whole, but such changes involving enlarged or reduced employment of productive power of various sorts are never such as admit that employment of “the joint-method of agreement and difference” by which the setting of Professor Clark claims to prove specific productivity for a unit of labor or for labor as a whole.

Even if we substitute composite units for simple units at the margin, they throw no direct light upon the distribution of the product. For if we take the standpoint either of a single entrepreneur, or of an entire industry, or of the whole trade of a country, the number of these composite units that will be employed, and the respective parts played by the different factors in composing the marginal units, are themselves determined by wider considerations relating to the available supplies of the various sorts of the several factors. When a general rise of industry is taking place, there is a desire of entrepreneurs to employ more units of the several factors; if they can buy these units at the same price as those they already employ, they will do so. and if they can so buy all the units of the several factors they require, there will be no change in the distribution of wealth, so far as rates of wages, interest, etc., are concerned, though a larger or a smaller proportion of units of labor, as compared with capital or land, may be called into use for the new enlarged production. But if the available supply of one factor is smaller than that of other factors, this relative scarcity will raise the price of a unit of this factor, not only as regards the new units employed, but as regards the old units also. If, for instance, while plenty of new capital is forthcoming upon virtually the same terms as that already in use, the labor available is inferior to that in use, so that a larger number of laborers must be employed at a price which raises the cost of labor per unit, the share of the total product taken by labor and the payment made for each unit will be larger than before. An increased demand for mutton may bring into sheep-farming a lot of inexperienced townsmen whose “units” of labor cost farmers more than the units represented by their former employees, or may lead farmers to extract extra-exertion from the shepherds already in their employ by a higher rate of pay.

The actual problem of distribution in a dynamic (i.e., a real) society is worked out by bargains at the extensive and intensive margins of employment of the several factors, It is a question of incurring and paying for increased costs of new units of productive power which cannot be got at the same rate as those already in use; the margin of employment must be lowered, either extensively to take in the use of technically inferior agents, or intensively to take in (by overtime or intensification of work) the inferior powers of agents already in employment.

The grading so generally adopted for land-uses must be applied to the other factors, if we are to grasp the problem effectively. For this purpose we require to take a thoroughly concrete view of the factors. As we lower the margin for land by taking in inferior acres or by cultivating more thoroughly (and more extensively) existing land, as we lower the margin for labor by employing worse workers or lower (and costlier) powers of labor in better workers, so in grading capital we must consider the new machines and other plant which can be got from the investing public as “capital” which lies below the extensive margin of employment for the purpose of this industry, while a fuller and less economical working of existing plant and machinery will be a lowering of the intensive margin.

All these cases, implying recourse to technically inferior agents or powers of production, imply a greater expenditure per unit of the new productivity. The practical problem of distributation depends upon the respective rise and fall of these margins considered with relation to the various applications of the law of substitution.

A general expansion of demand for commodities forces every entrepreneur to fasten his eyes upon the units of the several factors just below the extensive and intensive margins, to consider which lowering to adopt in each case where an increased number of units of supply is essential, and, having observed the rate of fall in the margins of each factor, to consider how far his business can be reorganized so as to substitute a larger proportion of those factors which can be got relatively cheap for that factor which is short in supply and therefore dear. Every change in general volume of production will by its reactions on the industrial arts and the organization of business, alter in many ways the proportions of the several factors which will be employed even on the assumption that the new increments of all the factors can be obtained at the same cost as the old increments; where, as will always be the case, some portions of the new factors will not be obtainable on the former terms, these reactions will be larger and more intricate.

The upshot of any general expansion of production will be to increase the proportion of the aggregate product paid per unit for some factors in comparison with others. This will occur irrespective of whether the industry, taken as a whole, conforms to a law of increasing or of diminishing returns. In the former event, ability, labor, or capital will increase in varying degrees the proportion of the enlarged aggregate product which falls to them; in the latter event land will strengthen its position. Regarded from the composite marginal increment a surplus or scarcity rent will accrue to that factor of the composite unit which is relatively short, and this rent will be necessarily shared by all the other parts of this factor. As a rise in the rent of an acre of land at the margin for any land-use gives a rise of differential rent to each acre above the margin, so is it with laborers or with concrete forms of capital: an increase in the price of a unit of productivity in any one of these factors gives rise to differential rents in the concrete embodiments of these units of productive power.

The only real service of margins in a theory of distribution is as useful indices enabling us to note and measure any rise of these scarcity rents which signifies a shift in the proportionate distribution of the aggregate product.

In Professor Clark’s “static” community, if based upon real conditions of industry, so far from getting rid of exploitation or unearned income, we should find one of the factors in a permanently superior position, taking for its share the residue of the product after paying a bare wage of maintenance to the others. It would, however, be impossible to prove which factor was in this advantageous position under “static” conditions, for there would be no means of so separating the productivity of the factors as to show that the return to one of these exceeded its productivity. If land were actually in this position, it would be claimed, as the Physiocrats did claim, that every increase of the product beyond the maintenance of the other factors was due to the inherent productive powers of nature; if the entrepreneur held the place of dominance, all that he received might be attributed to the intense productivity of his thought and skill.

When we turn to an actual dynamic industrial society, there is no reason to assert the permanent superiority of any one factor of production. Even if we confine our attention to the prevalent structural type of industry in advanced nations, where the entrepreneur’s ability buys and organizes units of labor, capital, and land for production, we are not at liberty to attribute to the entrepreneurs a general power so to restrict competition as to enable them to take and hold any surplus product left after the costs of the other freely competing factors are defrayed. In certain industries and in certain industrial societies land-owners may exercise a normal and a durable domination over the other factors, and what may appear to be a power of capital or of entrepreneurs will really rest on land-scarcity. In other new rising industrial communities capital may for a time be so far relatively short as to form the limiting factor of production; labor may for a season, or in certain trades, hold this position, using cheap abundant land and capital, and taking the surplus product in high salaries.

There is no warrant for Professor Clark’s view that in a dynamic society the gains arising from improvements in the arts of industry and the methods of business, held for a while by the entrepreneurs, must pass to the wage-earners as a permanent rise in their real wages. This theory is thus succinctly stated:

Profits: the lure that induces improvement, and improvement is the source of permanent additions to wages ... Dynamic theory has to show how great is the interval that induces the maximum rate of progress – how much entrepreneurs need, in the way of profit, in order to make them do all they can do to keep wages moving upward ... The vast sums that today are accruing to the rich who do the marshaling of the industrial line, are bound, under static law, to add themselves with an increase to wages and interest. They add, themselves, moreover, chiefly to wages. (p.412)

Now, this interpretation rests upon two assumptions: first, that these “vast sums” “accruing to the rich” are necessary costs of industrial progress; second, that the competition of entrepreneurs is such as to disable them from holding these gains and to compel them to hand them, over as permanent additions to wages. With regard to the first assumption, while it is true that some “lure” is required to induce entrepreneurs to invent or to adopt inventions and improvements in business, there is no reason to hold that the “vast sums” allocated to this purpose are economically applied. The amount of the gain which comes to a business man who adopts a new machine or puts on a new line of goods, and the duration of this gain, are chiefly determined by a variety of economic forces which have no direct reference to the minimum stimulus, or “lure,” which, as applied to the entrepreneur, is rightly considered a necessary cost of production. The change of business gives him a monopoly or a competitive advantage which is as large as he can make it, and lasts as long as he can hold it; and in many instances the gain vastly exceeds any payment necessary to evoke the change. Some gain is necessary, but the actual gain is determined by considerations of monopoly or scarcity. Then what is the ground for the second assumption, viz., that the entrepreneur class must hand over their gains to the workers? This will only occur on the supposition that the competition of entrepreneurs is keener and more persistent than that of workers. Is there any warrant for this supposition, either as regards single trades or as regards industry taken as a whole? It is quite true that when large improvements take place in a particular manufacture, raising the profits of employers, more entrepreneurs will plan to enter the trade, will increase the output, lower prices, and so hand over the chief gain to “the consumer.” But what right have we to identify the worker with the consumer, or to feel confidence that he can hold in a rise of real wages this gain from a fall of prices? The workers in a single trade do not, it is clear, get any considerable share of the value of the improvements in that particular trade. Do the workers as a whole get that gain? In order to answer this question fairly, we should take the case of a large general improvement of industrial method, for example, the application of steam or electricity to large fields of industry. Here the existing entrepreneur class, as a whole, is simultaneously put in possession of large gains from a variety of applications of the new power. Is there any economic force which shall bring into the held a sufficient number of new entrepreneurs to beat down profits, and so to expand the demand for labor in general as to raise its price? If, as Professor Clark assumes, the gains of improvements must pass chiefly to wages, he is bound to show that normally and necessarily, fluidity is greater and competition keener among entrepreneurs than among laborers. This he cannot show: the contrary is notoriously the case. Acording to his line of argument, the special profits of industrial improvements, though at first a necessary “cost” or “lure” for entrepreneur ability, cease to be so and become a real element of surplus value. What is the nature of the power by which the workers can wrest this surplus from the entrepreneurs and add it as an “unearned increment” to wages? For upon his analysis, when it passes to labor, it must be accounted an unearned increment. Professor Clark, indeed, suggests that the new “addition to the income of society” represents in some way an increased productivity of labor by the time when the laborers have succeeded in getting it.

Wages now tend to equal what labor can now produce, and this is more than it could formerly produce. When the full fruits of this invention shall have diffused themselves throughout society, the earnings of labor will equal the new standard rate. (p.405)

But, taking Professor Clark’s conception of the specific productivity of units of labor, there seems no ground for attributing to the increased productivity of labor a gain due in the first instance ex hypothesi to an output of the ability of entrepreneurs. There is, indeed, more reason in Mr. W.H. Mallock’s doctrine that this gain remains always of right the economic property of the entrepreneur, and that if the workers get it they are getting a dole from the earnings of ability. If a technical increase of the joint-product of a complex of ability, labor, capital, land, constituting a business, is attributed to the productivity of ability alone when it first occurs, how can it afterward be attributed to the productivity of labor? Are we to attribute anything anyone can get to his productivity? This apparently is what Professor Clark does here and elsewhere. He thus rules out ab initio the existence or the possibility of any surplus value or “unearned income.”

Summarizing my criticism of this portion of Professor Clark’s theory of distribution, I should say:

Finally, Professor Clark’s view of the function and income-taking power of the entrepreneur in a dynamic society seems to me defective in confining profit to this short tenure of the fruits of industrial progress. In most societies the entrepreneur class can and do make profit of another sort than this. The prime function of an entrepreneur is to buy units of the productive powers of labor, capital, and land at a price which measures their separate productivity [4], to use his ability to make these units co-operate so as to produce an aggregate productivity larger than the addition of these separate productivities and to take for his share this difference. If the competition of entrepreneurs were not only absolutely fluid but unlimited in quantity, this “difference” between aggregate and separate productivity would be cut down to the minimum “cost” of the ability of the entrepreneur in performing this organizing work, and no element of what may be called “pure profit” would emerge. Under such competition of entrepreneurs the gain of co-operative over separate productivity would pass to the owners of whichever of the factors were in a position of natural or artificial scarcity, i.e., admitted less fluidity and freedom of competition than the others.

Normally speaking, the competition of entrepreneurs is not thus free and keen. Over a large proportion of the field of activity, partly by preoccupation of markets, partly by superior experience in special lines of business, partly from superior access to sources of supply or to the use of capital, partly by express or tacit agreements, entrepreneurs have restricted effective competition among themselves, and are to that extent in a stronger position to buy in an open market units of land, capital, or labor-power. This power of the entrepreneur class is the most distinctive feature of the economic structure in the more highly developed nations, and is largely fed by those great improvements in transport which have taken place in the last few decades. Improved, enlarged, and cheapened transport has strengthened the position of the entrepreneur by placing at his disposal enormous new supplies of land, labor, and capital in less developed countries, without increasing in a corresponding degree the effective supply of entrepreneurs. The entrepreneur class of a few highly developed nations is enabled to exploit great new supplies of cheap factors of production. No doubt in. proportion as education, business training, and access to capital are open to a larger number of the population in advanced countries, and as the spread of industrial civilization brings the backward exploited nations nearer to the level of the advanced nations, this power of the entrepreneurs may be reduced, and portions of their gains may pass, not necessarily to labor, but to whichever of the other factors can establish a relative scarcity and so raise the price of each of its units of supply.

But it is important to recognize that, in modern industry, behind and in addition to this dynamic advantage of taking in profits each new increment of industrial improvement as it arises, the entrepreneurs over a large part of the industrial held enjoy a static advantage in buying’ units of labor and capital cheap and in selling the product of their co-operative use so as to take in profits of a large difference. In some parts of the industrial field limitations of raw material or space enable the landowners to cut down and divert much of this gain: less frequently capital or labor, specially protected by local or industrial circumstances, encroaches similarly on the power of the entrepreneur. But even if we stopped the springs of progress, and set industry in a “static” position, we should find that “profit,” as distinct from a competitive payment for organization, secured for entrepreneurs a large proportion of the aggregate wealth.

Normally, at the present stage in the evolution of world-industry, there is reason to believe that the largest share of the increase of world-wealth due to improved co-operation – or, in other words, to social production – passes to entrepreneurs first as profit, afterward as interest on an ever swelling fund of capital which is so closely welded into the entrepreneur’s dominion as to form an inseparable part of it, and that the smallest share passes to manual labor. In Great Britain, in the United States, and perhaps in certain continental countries of Europe, the truth of this generalization is obscured by very considerable advances in wages and standard of comfort of most grades of working-men. But these rises of wages among large classes of certain nations are quite consistent with the conclusion that labor is the weakest factor in the assertion of its claim in the increment of world-wealth.

In Great Britain the modern methods of industry which have brought the great majority of workers under the conditions of city life, and have set large masses of them to do skilled responsible work in co-operation with machinery, require a more expensive standard of comfort as an economic “cost.” The work done today could not have been got out of the miserable half-starved population of eighty years ago. This recognition of “the economy of high wages” has been reinforced by a humanitarian pressure of public opinion, assisted by industrial and sanitary legislation. The great increase of public and semi-public employment, in which political and other social considerations have operated to raise wages and shorten hours, has material!v assisted, both directly and as an educative force in popular sentiment, to raise the level of conditions of employment. The organization of labor, rising earlier or advancing faster in certain trades than the organization of employers, has for a time enabled large groups of skilled workers to keep their supply of labor relatively scarce and by collective bargaining to force up the price. Where profits have been high, as in certain rapidly expanding industries, supported either by a practical monopoly of a home market, as in the coal, building”, and printing trades, or by great advantages in foreign trade, as in the engineering and shipbuilding trades, it has been possible by skilled collective bargaining to extort concessions in the shape of higher wages out of the profits of the trade.

Finally, it must be borne in mind, a large and ever-growing proportion of entrepreneurs’ profits in Great Britain are drawn from foreign industry, either directly by setting masses of workers in backward countries to work with British capital and under British management, or indirectly by exchanging British goods produced by comparatively high-paid labor for foreign goods produced cheaply. The relative strength of the British employers may be less than formerly as compared with home labor, but any loss of exploiting power at home may be, and probably is, more than compensated by an increased exploitation of new large areas of cheap unorganized labor in other parts of the industrial world. This expansion of the area of cheap labor along with a rise in the wages of organized skilled labor is applicable also to the United States, except that a greater proportion of the cheap labor out of which a large margin of entrepreneurs’ profits is obtainable, is drawn into the United States to be exploited there instead of remaining in foreign lands.

There is no reason to suppose that in recent industrial enterprises labor as a whole possesses the power to bargain with the entrepreneur upon conditions which secure for it a larger share than formerly of the increased product due to inventions, improved administration, and other economies. Taking the whole industrial field into consideration, we should find that over most of it free, constant, effective competition was far more restricted among entrepreneurs than among laborers. The entrepreneur as buyer of units of labor-power, and even of capital, is usually stronger than the seller of these units, and there is no security of such close competition among entrepreneurs as shall oblige them so to reduce the prices of the commodities they sell to consumers as to hand over to the latter the gains they make from the cheap purchase of units of productive power.

|

|

J.A. HOBSON |

1. This, of course, would not be the exact amount of the yield of this marginal unit of land, but this amount minus the reduced yield of the rest of the land arising from a diversion of some labor, etc., which would have gone to it.

2. There is no footnote 2 in the printed original. – MIA

3. PROFESSOR EDGEWORTH, in the Quarterly Journal of Economics (January 1904) appears to think the Differential Calculus will assist him to find the productivity of the marginal shepherd by starting from the productivity of an infinitesimal margin of him.

4. Strictly speaking, of course there is no “separate productivity.” By “separate productivity,” however, here is meant the productivity which the owner of a single unit or other small quantity of a “factor” could get out of it by using it himself to form a separate business. A laborer’s “separate productivity” will signify what he could make as a “jobbing” laborer, or, where “free land” is available, what he could make by this alternative employment on his own account. So with a unit of capital, its “separate productivity” is what its owner could make out of its use in a little independent business of his own. An entrepreneur tries to buy his units of labor and capital at this price, and if there is not as keen a competition among entrepreneurs who buy as between laborers and capitalists who sell, he gets his units at about this price.

Last updated on 29.7.2007